Unexpected situation! Port calls are temporarily suspended, and booking of containers is halted! The freight rate for this route has surged by 55%! | Maritime Export Logistics

Jun 24,2025

A few days ago, due to the escalation of the conflict between Israel and Iran, Maersk and other shipping companies issued a statement suspending or reducing the number of their vessels docking at the Israeli port of Haifa and suspending the acceptance of cargo from Haifa, and analysts expect other liner companies to follow suit.

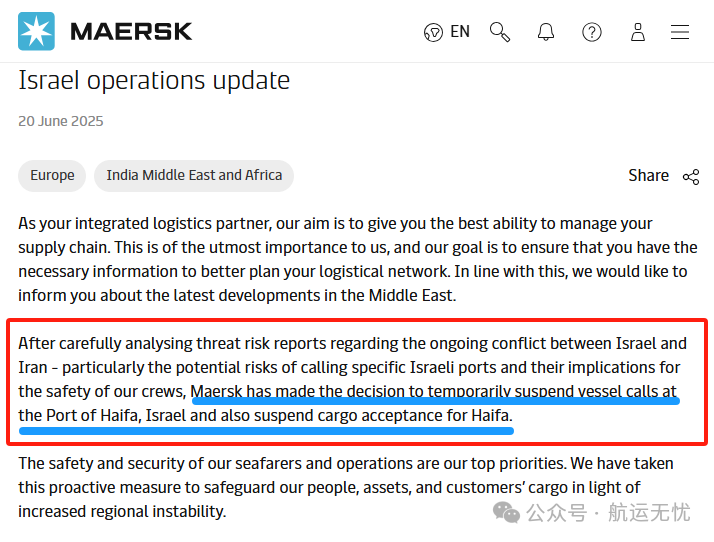

Shipping giant Maersk issued a statement on Tuesday suspending the port of Haifa and accepting its cargo because of the conflict between Israel and Iran. Maersk said that after careful analysis of relevant threat risk reports, particularly the potential risks of docking in Israeli ports and the impact on crew safety, it decided to suspend vessel dockings in Haifa.

Maersk stressed that the safety of its crew and operations was a top priority and, given the volatile situation in the region, the measure was designed to protect personnel, assets and customer cargo. Maersk has been in close communication with affected customers in an effort to coordinate alternative shipping options and reduce supply chain disruption, and will monitor the situation closely and prepare to reassess this decision when it is safe and feasible.

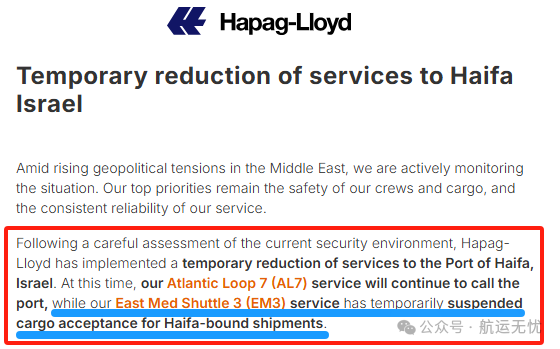

Hapag-lloyd also issued a notice on the 20th, in view of the Middle East geopolitical tensions continue to escalate, is closely watching developments. Ensuring the safety of crew and cargo and providing reliable service is a top priority. After a careful assessment of the current security environment, Hapag-lloyd decided to temporarily reduce services to the port of Haifa. Specifically, the Atlantic Loop 7 (AL7) service will continue to call at the port, but the East China Sea Express 3 (EM3) service has temporarily stopped receiving cargo to Haifa.

At the same time, the price of shipping routes in the Middle East has risen significantly since the war. Spot container rates between Shanghai and Dubai's Jebel Ali, the largest port in the Arabian Gulf, have soared, according to Xeneta. Prior to the escalation of the conflict, the average spot rate per 40-foot container (FEU) on the route was up 55% quarter-on-quarter to $2,761.

Peter Sand, Chief Precipitator at Xeneta, pointed out that the deteriorating situation in the Middle East has made seaborne trade across the Gulf of Alaba face higher risks and operating costs. Additional costs, including increased security, higher fuel prices and increased fuel consumption as ships increase their speeds to move quickly across high-risk waters, have pushed up freight rates.

According to SCFI, on June 20, Shanghai Port exports to the Persian Gulf basic port market tariff (shipping and shipping surcharges) was $2122 / TEU, up 1.9% from the previous period. The geo-risk of the Persian Gulf routes is high, transportation demand is generally stable, and immediate market booking prices continue to move upward.

Sand further warned that the "serious risk" of conflict escalation is clearly increasing, and the possibility of supply chain disruptions and further surge in freight rates is rapidly accumulating.

Previous Page:

Recommend

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18027165010

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback