Crash!! Freight rate drops by 18 %...

Feb 26,2025

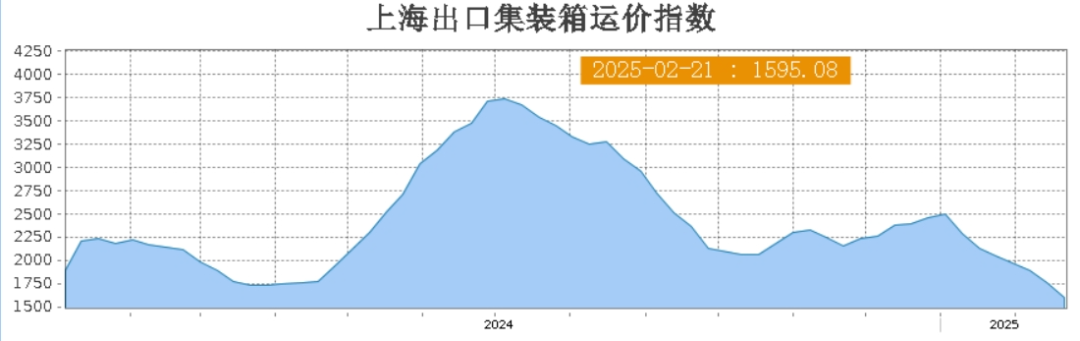

The latest issue of Shanghai Container Export Freight Index (SCFI) shows that the freight index has fallen for six consecutive weeks, and the four major routes are all green, especially the US line.

Far East to West America: The rate per FEU fell $637 to $2,907, a weekly decline of 17.97%.

Far East to East United States: The rate per FEU fell $871 to $3,954, a weekly decline of 18.05%.

Far East to Europe: The rate per TEU fell $30 to $1,578, a weekly decline of 1.87%.

Far East to Mediterranean: TEU fell $191 to $2,624, a weekly decline of 6.79%.

Near-ocean line freight prices are relatively stable

From the Far East to Kansai, Japan: Every

TEU rates were flat at $305.

Far East to Kanto, Japan: Rates per TEU were flat at $308.

Far East to Southeast Asia: The rate per TEU fell $17 to $440.

Far East to South Korea: Rates per TEU were flat at $137.

Shipping agency lowers its quota for early March

Industry sources pointed out that full resumption of work in China may not be until mid- or late March, when the restoration of shipment capacity will be key to influencing freight price trends. At present, the European line has appeared "tariff inversion" phenomenon, the spot market per FEU tariff of about 2200-2600 US dollars, while the contract price is 2500-3200 US dollars.

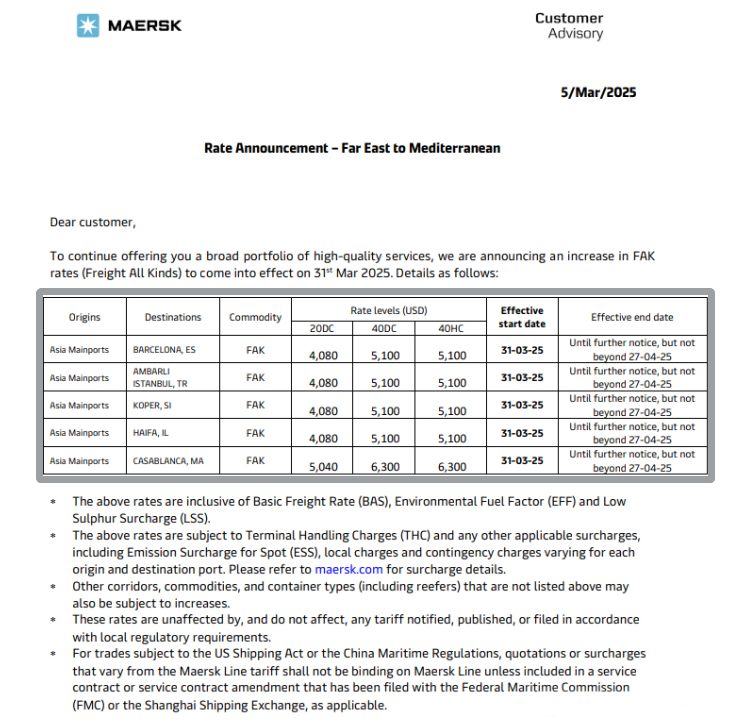

Facing price inversion, shipping companies plan to increase freight rates in March. In mid-February, major shipping companies such as Maersk, Delta Ships, Hyundai Merchant Marine and Wanhai Shipping announced increases in freight prices for Asia-Europe, trans-Pacific and intra-Asian routes, generally between 5% and 15%. However, a week later, Maersk lowered the 10th week (March 3-9) European line quotation to $3,200 / FEU. Mediterranean Shipping (MSC) from March 1 to 2 continued to use the end of February quotation of $2290 / FEU, March 3 quotation fell to $3940 / FEU.

At present, Yangming Shipping (YML) self-run FP2 route quotation 2800 US dollars / FEU, other routes 3000 US dollars / FEU, is currently the lowest FAK quotation in early March.

There could be a sustained rise after that.

Lei Yue, head of the shipping group at Haitong Futures Research Institute, said that there will be a normal price increase cycle after that, and according to the seasonal nature of previous years, the shipping industry will likely announce a sustained increase in April, May and June. Even if freight prices cannot fully meet the declared increase, they can at least raise nominal offers, leaving room for a subsequent correction, and even achieve a small, slow increase in core prices.

SCFI Tariff Specific Data

Shanghai to Europe: $1578 / TEU, down $30, down 1.86% week.

Shanghai to the Mediterranean: $2,624 / TEU, down $191, down 6.78% week.

Shanghai to the United States and West: $2907 / FEU, down $637, down 17.97% week.

Shanghai to the United States East: $3954 / FEU, down $871, down 18.05% week.

Persian Gulf route: $1,102 per crate, down $42 and down 3.7 percent on the week.

South American route (Santos): $2947 per box, down $412, or 12.3 percent on the week.

Southeast Asia route (Singapore): $440 per box, down $17, or 3.7 percent on the week.

The shipping market is changing, what will the future fares look like? We will continue to follow.

Previous Page:

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18011705178

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback