马士基率先发布4月涨价通知

Mar 08,2025

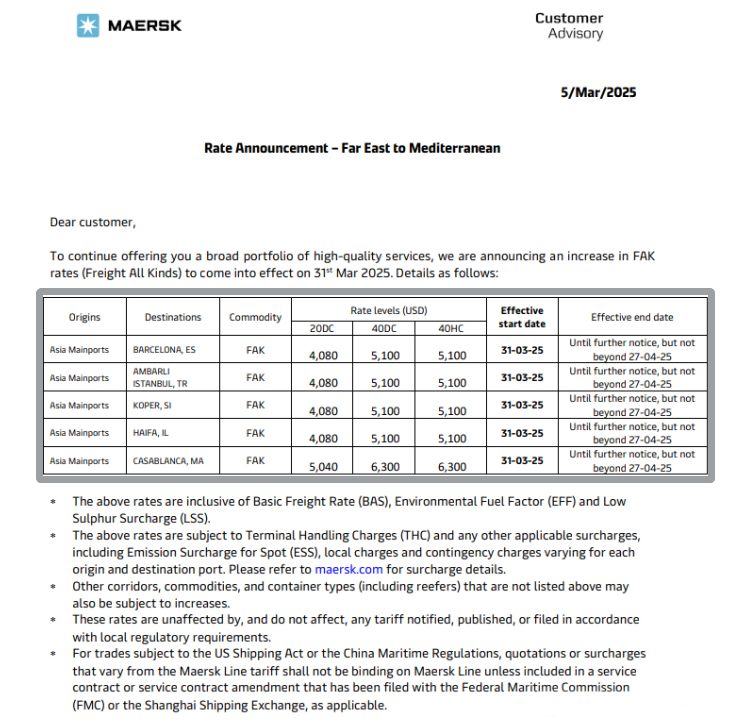

Recently, Maersk's official website issued a price increase notice, increasing the Far-East - Mediterranean FAK rate from March 31, 2025. The move marks the beginning of ship companies adjusting freight prices to cope with market changes and cost pressures.

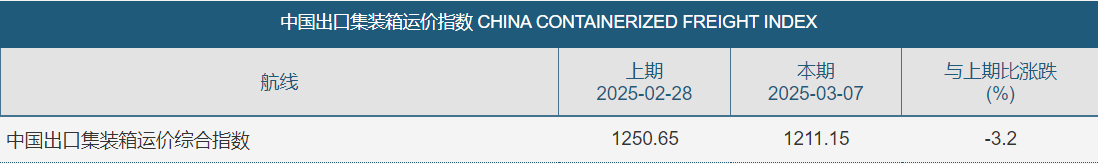

The latest composite index of China's export container freight prices was 1211.15, down 3.2 percent from the previous period.

The latest WCI index fell 3 percent to $2,541, 76 percent below its pre-outbreak peak and the lowest since January 2024.

Shipping companies plan to stabilize the market by reducing capacity (cancelling 6 percent of flights) and adjusting prices, but weakness on the demand side could prolong the weakness in freight prices.

The long contract signing season entered in late March, and if U.S. tariff policy is clarified, a pickup in shipments may lead to a stabilization or even rebound in freight prices. However, in the short term, the United States West route or continue to dip to $2500 / FEU.

If the situation in the Red Sea deteriorates again, the cost of circumventing the Cape of Good Hope could increase or support the European line. Prices on secondary routes such as Asia-South America may fluctuate or increase.

Pressures persist, and without a significant improvement in geopolitical conflicts and tariff policies, there is limited upside room for freight prices.

Maersk fired the "first shot" of April's price increase, and the price adjustments and capacity controls by other leading ships will directly affect market sentiment.

At present, the container shipping market is facing multiple challenges, and the transportation price trend is affected by many factors. It is recommended that relevant practitioners closely monitor market dynamics and adjust operational strategies in a timely manner to address potential risks.

Previous Page:

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18011705178

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback