Container shipping capacity retreat, MSC "cuts off" multiple routes in one go | Maritime export logistics

May 09,2025

Recently, the global shipping market is undergoing a profound rebalancing of capacity, particularly on the Asia-Pacific to North America route. With the sharp fluctuations in market demand, the strategic divergence among shipping companies is becoming increasingly obvious, especially the large-scale restructuring of Mediterranean Shipping (MSC).

Shipping data warehouse eeSea revealed that MSC has made a systematic adjustment to its five main routes in the past two weeks, which is far more complex than previous "skipping" or suspending routes. The Asia-Mediterranean "Phoenix" route has been closed, the East-West "Empire" route will officially be terminated after the final flight by the MSC Jasper VIII on 27 April, and the West-West "Orient" route is also facing a suspension, with the final flight being carried out by the Cape Kortia.

MSC's most iconic "pendulum" Asia-Europe - North America route Swan-Sentosa has also been split:

Swan will focus on Asia-Europe routes, investing 10 15,000 TEU class large ships, reserved for ONE, Yangming, HMM and other alliance partners as cabin leasers;

Sentosa has become an independent Asia-America-West route, operated by MSC alone, with the same ship type, still maintaining the 15,000 TEU class.

In addition, MSC will combine the original Shikra route to the Middle East / India with the Pearl route to the Western United States to form a new hybrid route. The overall ship size was reduced to 8,000 TEU, and the number of ships was reduced from 16 to 13, further reducing capacity.

At the same time, the "Ocean Alliance" (including Dafei, COSCO, Oriental Overseas, Evergreen) actively cut market capacity through large-scale "empty class" operations. According to Sea-Intelligence statistics, between April and May alone, a total of 58 flights were announced, more than half of which came from the Ocean Alliance, and the overall capacity decreased by 26% year-on-year.

In sharp contrast to the "Gemini" - Maersk and Hapag-lloyd. They did not release any empty shift plans, opting instead for a 8% annual year-on-year capacity contraction by switching to flexible cockpits for smaller vessels.

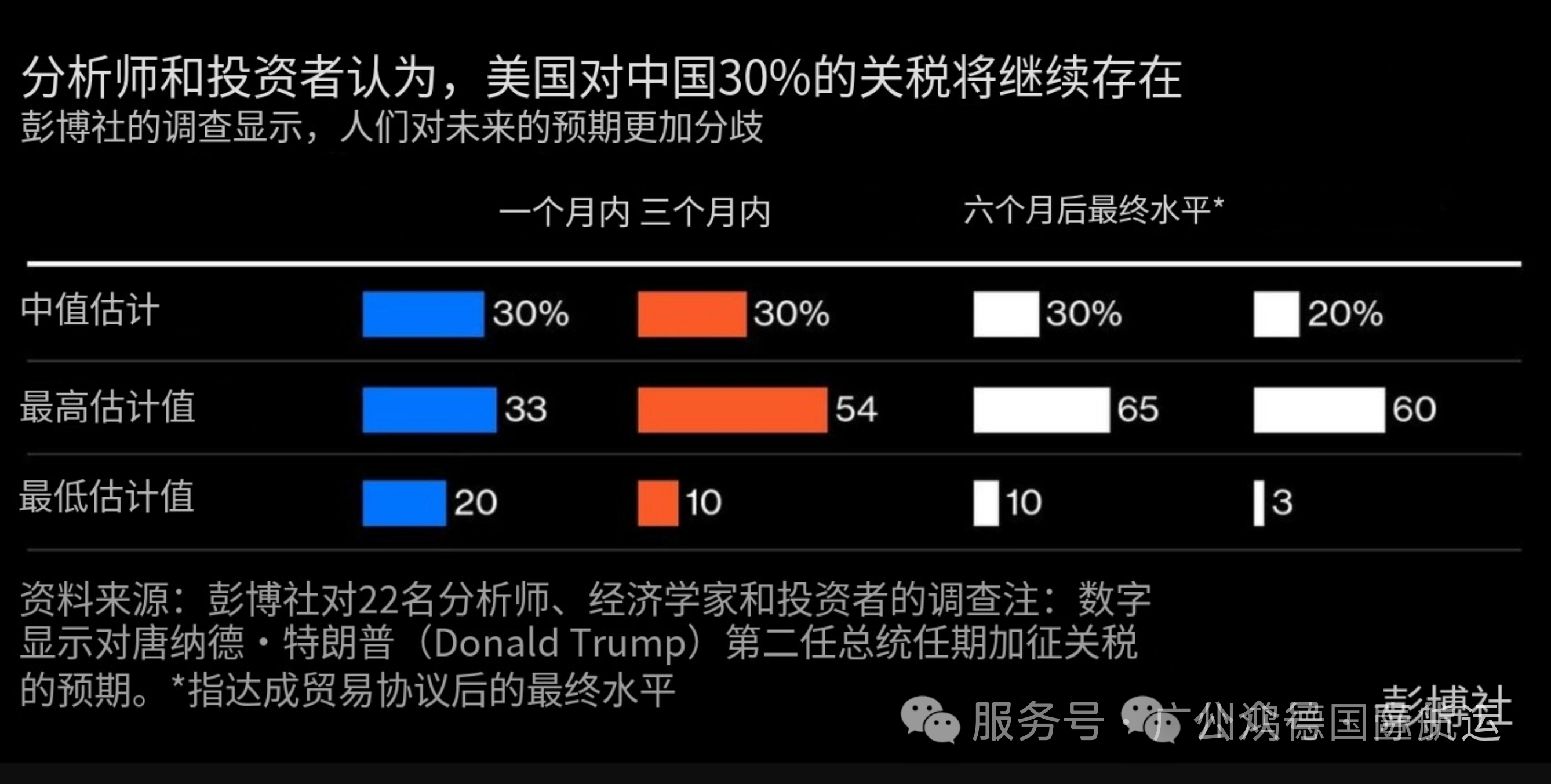

The root cause behind this round of adjustment is still the ongoing U.S.-China trade war. Data show that the total capacity of the Asia-US East Line since the outbreak of the trade war has fallen by 15 percentage point. A planned increase of 10.9 per cent in capacity has now turned into a 4.9 per cent contraction. Demand from Asia, especially shipments from China, is now generally reported to be down 30% to 50% year-on-year, and although orders from Southeast Asia and other regions are filling up, they are not nearly enough to fully fill the gap in the Chinese market.

The global shipping market is undergoing a profound transformation, with shipping companies adjusting their strategies to cope with the sharp fluctuations in demand. The massive restructuring of the MSC, the empty shift operation of the Ocean Alliance and the flexible control modules of Maersk and Hapag-lloyd are all different responses to the current complex market environment. In the future, with the further development of China-US trade relations, how the shipping market will evolve deserve our continued attention.

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18011705178

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback