Seven consecutive declines! The US West fell by 14.62%! Trump brings uncertainty!

Mar 04,2025

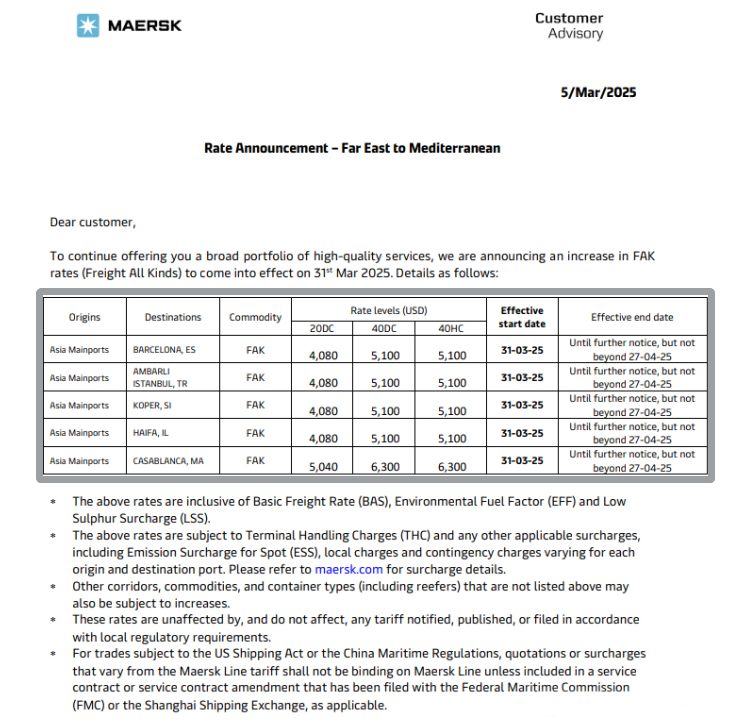

Recently, the container shipping market has continued to recover slowly, with freight prices down on most routes and the composite index falling. Shanghai Export Container Freight Index (SCFI) has been down for seven consecutive weeks, the latest index was 1515.29 points, down 79.79 points, or 5.00% from the previous period. With the exception of the modest increases on the European and Japanese lines, the other major routes showed a downward trend.

Image source: Shanghai Shipping Exchange abuse

European line: Shanghai to Europe freight rate is $1,693 / TEU, up 7.28% from the previous period.

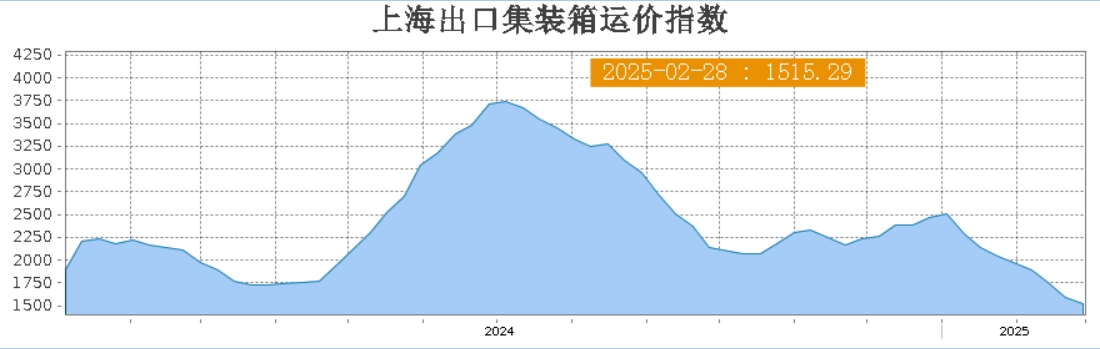

Sea Line: Shanghai to the Mediterranean freight rate of $2594 / TEU, down 1.14% from the previous period.

United States: Shanghai to the United States West and United States East freight rates were 2482 US dollars / FEU and 3508 US dollars / FEU, respectively, down 14.62% and 11.28% from the previous period.

Other routes:

Persian Gulf Line: Shanghai to Persian Gulf freight rate of $1015 / TEU, down 7.89% from the previous period.

South America: Shanghai to South America freight rate of $2770 / TEU, down 6.01% from the previous period.

Australia and New Zealand: Shanghai to Australia and New Zealand freight rate is $745 / TEU, down 9.81% from the previous period.

Japan Line: The Shanghai to Japan freight price index is 990.23 points, the transportation market is generally stable, and market freight prices have increased slightly.

U.S. President Donald Trump announced that he would further increase the level of tariffs in March, increasing the risk of trade conflicts and adversely affecting the North American air transportation market. The Office of the United States Trade Representative (USTR) has proposed charging Chinese ship operators $1 million per visit to an American port and up to $1.5 million per visit for Chinese-built ships, regardless of the country of the operator.

Industry insiders analyzed that the Trump administration's imposition of a charge on container ships built in China could trigger an increase in freight rates on the US route. Peter Sand, chief precipitator at Xeneta, warned that shipping companies could adopt evasive strategies, such as reducing the number of calls to U.S. ports, leading to congestion and delays at U.S. ports. Sand advises shippers to find workarounds by transshipping goods to the United States via Mexico and Canada, a trend that is already emerging.

Imports from China to Mexico in 2024 will increase by 15% compared to 2023 to 1.42 million TEU.

Imports from China to Canada rose 16 per cent to 1.8 million TEU.

Sand noted that Trump has vowed to head off this trend by imposing 25 percent tariffs on imports from Mexico and Canada. If shippers were to incur new port fees in addition to tariffs when importing directly to the United States, that could change things again, further boosting import growth from China to Mexico and Canada.

Image source: Xinhua

Industry insiders advised that this measure by the United States has added to the uncertainty of global maritime trade, and cargo owners and cargo shippers should promptly follow up on ship schedules, shipping prices and other information on relevant routes to prepare for transportation in advance.

Previous Page:

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18011705178

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback