European port congestion worsens, spreading to the United States and China! Shipping companies charge congestion surcharges | Maritime export logistics

May 27,2025

Recently, an unprecedented "storm of congestion" has swept the world's ports, from the Nordic hub to the gateway of China and the United States. Port delays, combined with trade wars and other factors, continue to push up the cost of shipping and disrupt the global supply chain.

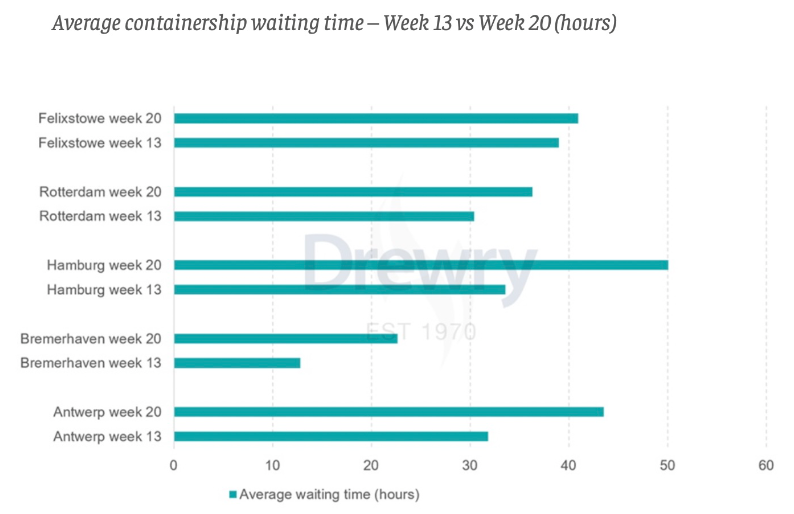

Key ports in northern Europe such as Antwerp, Rotterdam, Hamburg and Bremerhaven are being stuck in severe congestion. Parking waiting times in the port of Bremerhaven soared by 77 per cent between the end of March and mid-May, with delays increasing 37 per cent in Antwerp and 49 per cent in Hamburg, and Rotterdam and Felixstowe not immune.

On 20 May, the port of Antwerp-Brugge was hit by a nationwide strike, which further aggravated the situation. Labour shortages and low water levels on the Rhine are the main causes, limiting barge capacity and hampering inland logistics.

The number of container ships awaiting berth at major ports such as Shenzhen, Los Angeles and New York has continued to climb over the past three weeks, showing congestion patterns similar to those seen in Europe, according to Drewry. Port delays not only prolonged shipping times, but also disrupted inventory plans, forcing shippers to increase their stock. Shipping companies have been forced to reroute routes and introduce congestion-related surcharges.

The intermittent tariff strategy under Trump has made it difficult for importers and exporters to adjust orders, leading to volatility in demand. Previously, Trump's temporary withdrawal of the 145 percent tariff on Chinese imports led to an early increase in demand for U.S.-China shipping, and early signs of high season in Pacific Eastbound trade further exacerbated congestion.

Hapag-lloyd Chief Executive Rolf Habben Jansen said that despite recent improvements in European ports, it was still expected to take six to eight weeks to bring the situation under control. However, Thorsten Slok, chief economist at Apollo Management, noted that the U.S.-China tariff truce has yet to trigger a surge in ships in the Pacific, raising questions about whether the 30 percent tariff on Chinese goods is too high.

Trump's threat to impose 50 percent tariffs on the European Union could disrupt transatlantic trade. Additional policy uncertainty will increase the cost of global activity, with countries such as Germany, Ireland, Italy, Belgium and the Netherlands most vulnerable because of the high ratio of U.S. exports to GDP, according to the Oxford Economics Institute. Bloomberg Economic Research pointed out that a 50 percent tariff on EU products could bring EU exports to the US close to zero, reducing total exports by more than half.

Multiple factors pushed up freight rates in the seaborne spot market. Mediterranean Shipping (MSC), one of the world's largest container lines, has announced a general rate increase and peak season surcharge for shipments from Asia starting in June.

Since the Houthi attacks on Red Sea vessels in Yemen in late 2023, cargo ships have mostly bypassed South Africa, leading to changes in shipping routes. Habben Jansen said navigation in the Red Sea was still not safe and that it could take months to resume regular sailing of the Suez Canal to avoid port congestion. Freight rates are likely to continue to rise in the coming weeks, with serious challenges facing global trade and supply chains.

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18011705178

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback