Freight forwarders pay attention! Multi-country gray products are checked!!

Aug 02,2024

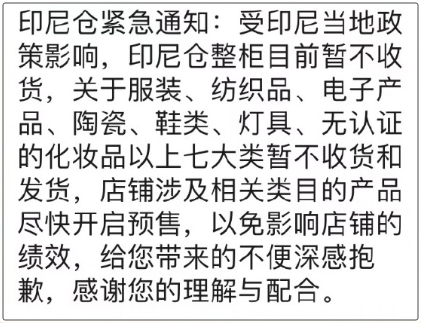

Recently, in response to the problem of illegally imported goods, the Indonesian government found that these goods entered the Indonesian market through gray customs clearance, which disrupted the market order, affected the development of domestic industries, and led to a substantial reduction in national tax revenue. In order to strengthen the supervision of illegal imports, Indonesia has set up a task force composed of various ministries and agencies to focus on seven categories of goods that are particularly vulnerable to illegal imports,Includes textiles, clothing and accessories, ceramics, electronics, footwear, cosmetics and other finished textiles.

According to the Indonesian Trade Minister, the Illegal Import Working Group found a batch of illegally imported goods worth 40 billion rupiah in the area north of Jakarta.

These goods are imported into Indonesia by foreigners by renting warehouses and selling them online without the necessary documents and without the Indonesian National Standard (SNI) certification. Seized itemsIncluding electronic products, reflex massagers, mobile phones, tablets, sprayers, electronic cigarettes, children's toys and clothing, etc.For seized illegally imported goods, the Indonesian government has taken measures to destroy them to prevent them from continuing to enter the market.

He also expressed regret that foreigners were able to import and sell goods in Indonesia "so freely. He pointed out that such illegal imports not only disrupt the domestic market, but may also lead to a substantial reduction in national tax revenue and seriously affect the development of domestic industries.

It refers to a customs clearance method in which the exporter, in order to avoid complicated customs clearance procedures, hands over all matters related to customs clearance to a special customs clearance company.

These customs clearance companies usually use "charter charter tax" and "charter tax" to help imported goods enter a country's market at a tariff lower than the legal level, but the customs clearance procedures are not transparent, and the total amount of customs duties and import taxes paid is significantly less than the legal tax amount. According to Indonesia's Customs Law No. 17 of 2006, illegal importers face 1-10 years in prison and a fine of 50 million to 5 billion rupees.

according to relevant information reports,Government of VietnamThe seizure of overseas warehouses has begun. The seizure operation is mainly aimed at several large overseas warehouses. Most of the products stored in these warehouses are high-value digital 3C and infringing high-order products that are smuggled into China through land transportation and automobile transportation.

reasons for the seizure of the warehouse:

Smuggling and infringement: The products in the warehouse involve smuggling and infringement, especially high-value digital 3C products such as mobile phones and tablets, as well as high-order products such as toy handstand. The Vietnamese government is comprehensively adjusting the customs system and officials to strengthen the supervision of gray customs clearance in order to eliminate the chaotic customs clearance conditions that existed before.

Make global trade unimpeded

Contact Phone

Contact Us

Copyright ©Guangzhou Hongdex International Logistics Co.,Ltd

Hotline: 020-84608598

Whatsapp: 18027165010

QQ:2853396538

Email: 2853396545@qq.com

We will provide you with timely feedback